Algorithmic trading companies Market Overview:

The Algorithmic trading companies market research provides a comprehensive insight into the competition, including the market share and company profiles of the world's biggest rivals. The research scope covers a comprehensive examination of the Algorithmic trading companies Market, as well as the causes for variances in the industry's growth across a variety of sectors.

Request for free broacher: https://www.maximizemarketresearch.com/request-sample/29843

Market Scope:

Top-down and bottom-up approaches are used to validate market size and estimate market size by segment. The market estimations in the research are based on the sale price (excluding any discounts provided by the manufacturer, distributor, wholesaler, or traders). Weights based on usage rate and average sale price are applied to each area to generate percentage splits, market shares, and segment breakdowns. The country-wise divisions of the overall market and its sub-segments are determined by the percentage adoption or usage of the specified market Size in the relevant area or nation.

Request for free sample: https://www.maximizemarketresearch.com/request-sample/29843

Segmentation:

Algorithmic trading is the methodical process of carrying out automatically pre-programmed trading instructions while examining factors like volume, price, and time. It supports decision-making in the financial sector by utilising strong mathematical tools. It is used to provide traders a speed edge over conventional human traders while processing data. Algorithmic trading makes decisions regarding whether to purchase or sell financial instruments on an exchange by using intricate calculations, mathematical models, and human oversight. High-frequency trading technology, which enables a business to execute tens of thousands of trades per second, is frequently used by algorithmic traders.

Key Players:

Primary and secondary research is used to identify market leaders, and primary and secondary research are used to calculate market revenue. In-depth interviews with important thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives were conducted as part of the primary study. Primary research comprised in-depth interviews with key thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives, while secondary research included a review of the main manufacturers' annual and financial reports. Secondary data is used to determine percentage splits, market shares, growth rates, and worldwide market breakdowns, which are then cross-checked with primary data.

The biggest players in the Algorithmic trading companies market are as follows:

• Algo Trader GmbH

• Trading Technologies

• Info Reach

• Tethys Technology

• Lime Brokerage LLC

• Flex Trade Systems

• Tower Research Capital

• Virtu Financial

• Hudson River Trading

• Citadel

• Technologies International

• Argo Software Engineering

• Automated Trading Soft Tech

• Kuberre Systems

• Meta Quotes Software Corp.

• Software AG

• Thomson Reuters Corporation

• u Trade

• Vela Trading Systems LLC

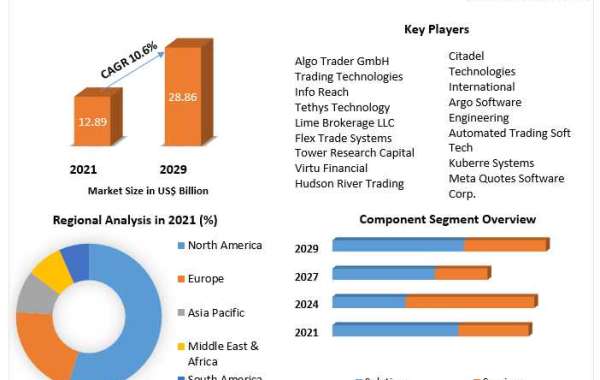

Regional Analysis:

Individual market influencing components and changes in market laws impacting current and future market trends are also covered in the Algorithmic trading companies market analysis regional overview. Current and future trends are studied in order to evaluate the overall market potential and find profitable patterns in order to get a firmer footing. The geographical market evaluation is based on the current environment and anticipated trends.

COVID-19 Impact Analysis on Algorithmic trading companies Market:

End-user industries where Algorithmic trading companies are utilized saw a drop in growth from January 2020 to May 2020 in a number of countries, including China, Italy, Germany, the United Kingdom, and the United States, as well as Spain, France, and India, due to a halt in operations. This resulted in a significant decrease in the revenues of enterprises in these industries, as well as in demand for Algorithmic trading companies manufacturers, harming the Algorithmic trading companies market's growth in 2020. End-user business demand for Algorithmic trading companies has decreased as a result of lockdowns and an increase in COVID-19 occurrences throughout the world.

Key Questions Answered in the Algorithmic trading companies Market Report are:

- In 2021, which segment accounted for the most share of the Algorithmic trading companies market?

- What is the competitive landscape of the Algorithmic trading companies market?

- What are the key factors influencing Algorithmic trading companies market growth?

- In the Algorithmic trading companies market, which region has the most market share?

- What will be the CAGR of the Algorithmic trading companies market during the forecast period (2022-2027)?

Will You Have Any Questions About This Report? Please Contact Us On link

About Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Phone No.: +91 20 6630 3320

Website: www.maximizemarketresearch.com