Introduction

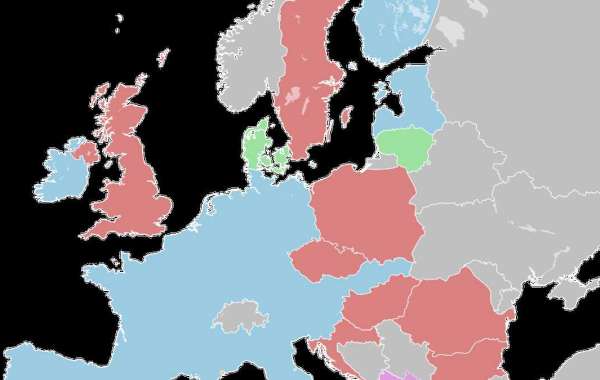

This critical analysis focuses on the policy prescriptions and their performance during Eurozone crisis. In order to effectively conduct the analysis various concepts it will be explored such impacts as the impact of monetary policies on stock, the impact of monetary policy on bond yields and quantitative easing. The main concern of economic policy makers is to come up with sound monetary policies, which are geared towards maximum employment creation and stable prices. Therefore, this analysis will begin by addressing monetary policies and focusing on their objectives. In fact, the rate of the unemployment is relatively on the increasing trend due to the recent economic recession, coupled with the Euro-zone debt crisis, which is shown in the following graphical representation. As a result of the Euro-zone debt and crisis, the bond yields are on a continuous decreasing trend as evidenced on Greece, Ireland, Portugal, Italy and Spain, as shown in the chart on a 10-year government bond yield.

Source: http://graphics.thomsonreuters.com

Critical analysis of proposed policies on Eurozone crisis

It has been reported in this Walls Street Journal that: “When Fed policy makers meet, one critical issue will be whether they downgrade their forecasts much. In April, they predicted the economy would grow between 2.4% and 2.9% this year, and the jobless rate would fall to between 7.8% and 8.0%” (Hilsenrath 2012, p.1). Precisely, these highlighted quotes from the text relate to the monetary policy on maximum employment creation.

Moreover, it is evidenced that the Fed policy makers are making some break-through in creating more jobs to reduce the rate of unemployment. Focusing on the graph shown below, annual unemployment rate has decreased in the United States by about 1%, that is, from about 9.4% in January 2011 to 8.5% in January 2012. In addition, a further decrease has been realized, as evidenced in the following chart. However, after April 2012, the rate of unemployment has started showing an upward trend. This can be attributed to the recent global financial crisis.

In essence, both Fed and central bank policy makers should realize the current monetary policies are not working towards creating a stable employment. Therefore, other alternative measures, which stimulate the economy, should be implemented. Other alternative monetary strategies, which can be explored, are the bank bailout programs. The following paragraphs outline this alternative action with its drawbacks.

Bank bailouts are ways of giving a loan or capital to an entity like a company, individual or a country that is in a danger of bankruptcy, insolvency or total liquidation. It can also mean helping a falling entity to stop spreading it effects to all sectors of the economy since this can have adverse effects. The bank bailout costs can be used to rescue the firm’s assets. Often, it is the government that funds the bank bailouts, through the loans advanced to the firms, so that the companies pay back the earlier debts, which they borrowed from other organizations (Cannadine 2006 p.102).

Focusing on the U.S government history of bank bailout, the Penn Central Railroad bank bailout in 1970 incurred $3.2 billion, while in 2008 the Trouble Asset Release Programme (TARP) emergency economic stabilization act made the government use $700 billion to bank bailout the banking sector from the mortgage crisis (Graham Dodd 2010, p.97). Bank bailouts were adopted as a way to save the economy from collapsing. The government’s involvement in the bank bailout raises some disagreements on the prevailing free market economy systems that currently exist. Other stakeholders in the market raise issues why some sectors of the economy are bailed out. The stakeholders view the situation as unfair practice, because when they have financial downtime, they face it without any financial assistance from the government. Like the national reserve, the government created high liquidity with a financial policy plan that encourages people to access mortgages, which they could not initially afford. This has led to the “fall of Fannie Mae and Freddie Mac, which have negatively affected the economy” (Hummel 2007, p.125).

The Federal Reserve Bank spent a lot of money, about $1.1 trillion on the financial institutions in exchange for the paper securities to inject into the banking system. In addition, $700 billion was added to the funds already circulated in the economy, five months before the Trouble Asset Release Programme (TARP). The $700 billion would be used by the paper worthless organizations with no possibility of good returns on the tax payers’ money. If the banks were to make money from the floated papers on the mortgage security, there would be no need for the government bank bailout; instead other enterprising institutions could have purchased those papers. However, it seems from their projection and analysis that this financial plan was likely to fail (Graham Dodd 2010, p.143).

In a market economy, it is a tough competition and others have to win, while other stakeholders lose. If the banks, which were ineffective, inattentive and negligent in their decision making are rewarded by the government bank bailout program, this sends a wrong signal to other banks, which are prudent in their decision making and had put in place good strategies to enable them survive in the competitive economy. Arguably, these well run banks ought to be stronger and more profitable than the ineffective and poorly managed ones. When banks do not lend their own money, but only advance the depositors’ funds, these institutions may go under (Abel Bernanke 2005, p.79). In such a case, the depositors tend to move their funds to some safer financial institutions. For example, when Merrill Lynch was subsumed by the Bank of America there was no big problem since the resources were efficiently moved, marketed and the tax payers did not have to bear the burden of the bank bailout. Similarly, when Mutual Washington collapsed, they opened the next day as a part of JP Morgan, not even one depositor lost money, not a customer lost his/her line of card and not a taxpayer’s dollar was required for this financial relocation plan (Thornton 2006, p.43).

Other than being unnecessarily expensive, the bank bailout money was used to keep the business partners afloat, but, this could have been the prime time to allow the market place to sweep out the poor investment firms and the negligent banking facilities to allow the rest to enjoy the prosperity gained on investing in the secure knowledge that the best performing banks had adopted in carrying out their financial activity, and this could make them survive the competition. The sale of WaMU broke the rule of one-failure only; the increasing risk effects by the Wall Street firms still continue growing. This is something they had been accustomed to since the only time they avoided the risk was after the great depression when the firms went insolvent, but the rest of the actions clearly show that their risk-seeking would come in full force and push them to the next financial crisis. The bank bailout makes the big financial institutions lazier than their competitors. These weak financial institutions are like the pets to the government. Therefore, the government has always felt the effect of the economic depression since these firms have never taken sound strategies to prevent the financial crisis (Thornton 2006, p.69).

The bank bailout program made the United States annual deficit of the budget for fiscal year 2009 to exceed $1 trillion. The proposal of Paulson, the Federal Treasury governor would lift the debt of the United States Federal ceiling by $700 billion, that is, “from $10.6 trillion to $11.3 trillion, but this could not be realized” (Rudebusch 2005, p.248). Moreover, “$700 billion would stop the problems facing the financial institutions, and the piecemeal approach could have great cost impact later,” (Hummel 2007, p.112). The total fund to rescue the toxic-mortgage fallout has been approximated to be more than $2 trillion; this includes the payment-adjustment problems, which were to come in 2009 and 2010 (Graham Dodd 2010, p.64). Looking at the collapse of Washington Mutual that failed largely due to the imprudent ARM loans, is a clear example of how a government’ action can assist in preventing a tax-costly crisis. If for example, the ARM-loan crisis can be solved at zero cost to the taxpayers, then others can be potentially solved at a lesser cost, if rescued at the moment before it goes out of hand. Deploying the bank bailout package now should be made for similar pre-emptive costs, which can be spent in the future and even lead to a global economic crisis.

Source: http://www.tradingeconomics.com

This Wall Street Journal highlights the following concerning prices, as quoted from the text: “other officials believe the Fed should be doing much more to spur growth, especially at a time when inflation looks to be planted near the Fed's 2% objective” (Hilsenrath 2012, p.2). This quoted statement relates to the monetary policy of price stabilization. Price instability causes inflation in a country, thus impacting negatively on its Gross Domestic Prices (GDP). For example, the United States’ inflation rate was at its peak during the months of July 2011 and January 2012. This was as a result of the increasingly high prices of energy, that are oil and gas. Consequently, high prices of energy products pushed the costs of the other consumables, thus leading to the high rates of inflation.

Source: essay reviser

The following quotations can be used to re-affirm the above statements: “the gasoline index fell 2.6 percent in April and accounted for most of the decline in energy, though the indexes for natural gas and fuel oil decreased as well” (Trading Economics 2012, p.1). The high inflationary tendencies, which rocked the United States during June 2011 and January, were responsible for low rates of unemployment. The reason for this is that the inflation rate has an inverse relationship with an unemployment rate, as illustrated by Phillip’s curve shown below. However, in the long run, there is no correlation between inflation and unemployment rates. Moreover, it does not necessary mean that a zero unemployment rate implies a zero-inflation rate. This is due to the fact that it is not possible for a country to experience a zero-inflation rate.

Phillips Curve: in the Short –Term.

Fed’s monetary policy on interest alone, would not spur any significant growth in the economy since increasingly high inflation rate does not lead to a proportionate reduction in the rate of unemployment. This is so because the inflation rate increases at a faster rate than the reduction in the rate of unemployment. Therefore, Fed would need to combine several monetary policies so as to achieve its objective of the price stability.

Hilsenrath Jon ascertained in this Wall Street Journal that: “policy makers could take bolder action such as launching another large round of bond purchases if they become convinced of a significant slowdown” (Hilsenrath 2012, p.1). Indeed, this statement is directly linked to the concept of quantitative easing. This is a policy, which is often opted by the central bank when there is no significant decrease in the federal funds rate. It is a monetary policy, which is employed to increase the money supply. When it is implemented, the prices of financial assets, which the central bank buys, are increased, and this action consequently reduces their rates of yield in the long term. This is an important monetary policy because it enables a business to secure monetary credit facilities in order to expand their enterprises at lower rates of interests. As a result, this action is expected to stimulate the economy. Moreover, this monetary policy tool should be used sparingly since it can make the economic condition worse. Quantitative easing can lead to excess bank reserves, thus causing more money supply, circulating in the economy. This results into the currency devaluation, which is a major cause of inflation that impacts negatively a country’s international-credit rating as well as its rate of foreign exchange.

Even though, Fed is encouraging the use of quantitative easing as a tool for monetary policy to be employed in managing the current economic situation, it is not all effective, and should be exercised by the central bank with a lot of caution. For example, Fed’s anticipated policy on purchasing a lot of bonds is likely to be resisted by the central bank since such actions may lead to inflation, thus a further economic slow down.

Conclusion

Summing up, Fed policy makers should opt for those monetary policy tools, which are geared towards stimulation of the economy. Unconventional monetary policies such as quantitative easing must be implemented with a lot of caution since they can lead to inflationary tendencies, which negatively affect the country’s credit rating. In essence, monetary policies are aimed towards stabilizing prices, employment creation and reducing interest rates. However, there are certain cases when these policies fail, and this calls for the use of the bank bailout programs, as an alternative measure. This is an important tool that the Fed policy makers ought to advise the government to adopt so as to stimulate the economy.